Weekly Market Report 11/26/2024

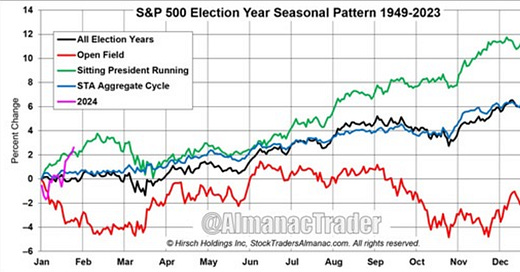

Seasonality Charts:

When I look at the seasonality charts for both S&P and Tech sector, I mentioned we were expecting a dip for mid/late November and I think that’s what were seeing now in the RISK ON market. Getting the final dips before ending off November with the thanksgiving holiday.

Good news is that we are expecting a final push out of November still into December and for rest of the year we are expecting higher prices amongst the RISK ON assets.

Also I noticed we are expecting another dip perhaps into the first week of December after we push out of November and one final dip closer to mid Dec. Seems like although we are expecting higher prices we still have dips along the way which can present some good buying opportunities.

S&P:

Location: Looks like were back against our ATH’s against the 4.669 resistance level. Price came down last week and kissed our 2 MA’s (13 EMA, 30 SMA) and held as support.

Momentum: Seems like bull volumes are waking up and stepping in now. No bull divs on MACD or oversold conditions hit however.

Structure: Got a V bottom working now in price.

As we continue to make higher lows and higher highs potentially here we are still in an uptrend. Last weeks dip seemed to have held well and reversed but now up against ATH’s again where we need to see it break through. Based on seasonality I think we had our mid/late Nov dip last week and now were back on track to creating higher prices into Dec. Its also thanksgiving weekend so expect some volatility. No setup lining up here though for me.

Nasdaq:

Location: Seems like market bounced off its MA’s like S&P last week. Coming up against its ATH’s again.

Momentum: Bearish div on MACD still live and no signs of bullish reversals except for the bull volumes stepping in.

Structure: V bottom working in price now.

Based on our seasonality charts the dip from last week was expected. Now that were coming into Dec here price is suppose to head back higher. We need to see price break above ATH to continue this uptrend. No setup for me here though like S&P.

DXY

Location: We are at local ATH’s now breaking out of the range finally last week. Still a bit away from our 61.8 short RLZ though now off the larger range.

Momentum: Bearish div on MACD still building and embedded in our overbought conditions.

Structure: V Top structure got broken from last week. Now looks like we have a downside inside bar working. Ideally want to see a dbl top.

DXY finally broke out this range from July but seeing momentum still showing lots of bearish signs. I believe there is a correction due here soon and just waiting for a dbl top structure to give me the green light finally. Might have to see price tag that 61.8 first as well but lets see.

DXY still seems to be quite correlated to the RISK on market as well

BTC

Location: Breaking down from ATH’s with our upside objective still there and also our downside support level at 38.2s from the most recent range lining up at 80k. Currently sitting on our 13 EMA as potential support.

Momentum: Bearish divs confirmed on MACD and in overbought conditions

Structure: Dbl top confirmed and playing out.

This is why I mentioned we should not chase price action last week as we were expecting a correction soon and this is it. I dont know how far well have to come down but 38.2 first stop supports where Ill be eyeing. Hopefully we dont break down that far though.

ETH

Location: Within short RLZ still (61.8-78.6 fib level)

Momentum: Potential bearish divs on MACD now and overbought conditions

Structure: V top coming in now.

ETH looks like its breaking down and correcting here. Seems there is a lot of resistance up against these previous highs and this RLZ keeps pushing price down. Momentum is breaking down now as well.

ETH/BTC:

Location: Within long RLZ’s (61.8-78.6) still.

Momentum: Bullish divs on MACD confirmed already and oversold conditions hit.

Structure: Dbl bottom came in few days ago and playing out now.

ETH finally had its wake up call throughout last week. Still quite early to tell though as it wasn’t a big move. I like that we finally put in a dbl bottom here but its going to be retested which needs to hold.

ALTs + Stables + BTC Dominance Chart

Nice dbl top came in on the BTC.D within its short RLZ last week giving the ALT index’s a big pump throughout the week. Now seeing a bit of a pause here as BTC n ETH breaks down.

Stable coin dominance has been falling off a cliff which is a great sign but looks like its starting to pick back up here as the market is correcting. No dbl bottom though just a V bottom which eventually gets retested.

Dont want to see the ALT index’s putting in dbl tops here.

Fear & Greed Index

Still within the Extreme Greed part of the index however it has fallen down from last week where we were sitting at a high 90 value. Seems market is correcting right now and the index is starting to cool off slightly.

ALTCOIN Charts:

So like I was saying in past reports DO NOT CHASE as markets will give us opportunities for dips! Looks like we are getting the dips on some names now and this is where you should be gathering your list of names you like and missed.

We are still in extreme greed on the fear/greed index which isn’t the ideal location for heavily deploying. Still would like to see the index be closer to neutral/fear but such is life, nothing is ever perfect.

I like that were getting this correction in some of the ALTS as this will help reset a lot of their momentum that was showing bearish signs like divs and overbought conditions. A wash was needed in order to clean up their charts before we start seeing the continuation in higher prices.

I’m still hitting 2x’s on names we picked over the last few months throughout the week (look through old reports) so finding new setups have been quite difficult. Mostly been in profit taking mode then buying. However here are a few that still looked decent to me. Never FOMO and chase into price action! Hunt the setups!

Also find the WEEKLY DBL BOTTOMS! Those are the best charts out there. Find the weekly’s and then look for the retracement on those! I will go over some next week perhaps

AIR:

Location: Within our long RLZ sitting against the 78.6 fib level

Momentum: Bullish divs on MACD and oversold conditions hit early Nov

Structure: Dbl bottom in price

RPL:

Location: Against bottom of its range

Momentum: Bullish divs on MACD and oversold conditions hit early Nov

Structure: Dbl bottom in price

RSS3:

Location: Still within its long RLZ

Momentum: Bullish divs on MACD and dbl bottoms on RSI across the 50 line

Structure: Triple bottom in price forming

VELO:

Location: Still within its long RLZ

Momentum: Bullish divs on MACD and dbl bottoms on RSI across the 50 line

Structure: Dbl bottom in price

AXL:

Location: Consolidation along the 38.2 first stop support level.

Momentum: No divs or oversold conditions hit. Dbl bottom in RSI across the 50 line. Mostly a trend continuation setup here.

Structure: Dbl bottom in price

NEWS:

Bitstamp CEO discusses Robinhood acquisition and bitcoin price action | The Crypto Beat ep. 12

Crypto derivatives market turns cautious ahead of FOMC minutes and PCE data, analysts say

Binance launching BFUSD, promising APY 'will never go below zero'

Movement developers plan token generation event on Ethereum ahead of mainnet launch

Pump.fun removes livestream feature amid reports of shocking videos

Justin Sun's Tron buys $30 million of Trump-backed World Liberty Financial tokens

Ripple announces tokenized money market fund launching on XRP Ledger

US Customs halts Bitmain ASIC imports amid speculation over sanctions: report

Michael Saylor's MicroStrategy Makes Mammoth BTC Purchase, Adding 55,500 Tokens for $5.4B

Axie Infinity game developer Sky Mavis lays off 21% of workforce

Hong Kong's ZA Bank lets users trade crypto against fiat currencies on its banking app

Lutnick, Cantor Fitzgerald negotiated a 5% ownership stake in Tether: WSJ

Trump nominates hedge fund manager Scott Bessent as Treasury secretary

SEC chair Gensler's departure sparks hope for compromises in crypto cases, regulation

Cboe announces December debut of spot bitcoin ETF index options

Polymarket blocks French users amid regulatory scrutiny over $80 million Trump election bet

Donald Trump's media company files trademark application for 'TruthFi', a crypto payments service

Bitwise Joins Mounting Race for Solana ETF

Links + Affiliates :

Affiliates: https://linktr.ee/simplejackx

Follow me on X: https://x.com/RamboJackson5